There is a tide in the affairs of men

Which, taken at the flood, leads on to fortune;

Omitted, all the voyage of their life

Is bound in shallows and in miseries.

On such a full sea are we now afloat;

And we must take the current when it serves,

Or lose our ventures. — William Shakespeare, Julius Caesar.

Since the recovery from the dot-com crash, doomsday prophets have consistently warned of a bubble in the private technology company ecosystem. This may sound like a valid concern to Silicon Valley-outsiders confronted with a spectacle of far-fetched startup ideas, wild blow-ups, and the transfer of large sums of money into the hands of audacious twenty-somethings. But we are not in a tech bubble. Iterative, trial and error experimentation is the mechanism by which firms drive the evolution of the market economy; it is the natural adaptation of industry to new technological paradigms. Moreover the amount of money involved in this vital discovery process is a tiny fraction of total economic output. Like any industrial revolution, the present era is one of rapid flux of the economy in response to new technological possibilities. Economic historians looking back on the present period will characterize it as the early innings of Golden Age of the information technology revolution.

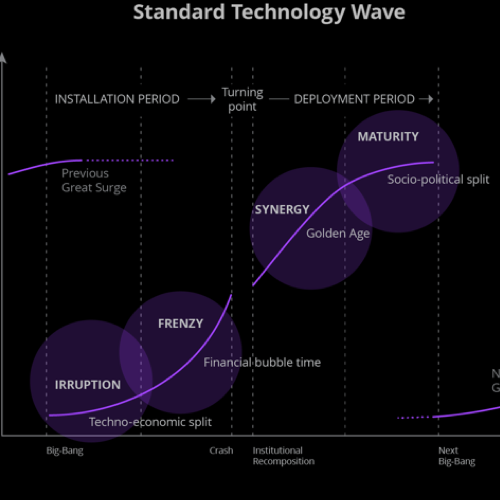

In Technological Revolutions and Financial Capital, Venezuelan economist Carlota Perez points out that our era’s first four technological revolutions all follow the same basic pattern: the eruption of the new technology, a feverish speculative frenzy, a recessionary economic collapse, a prosperous Golden Age, and a maturity phase of slowed economic growth once the technology has fully penetrated the market. Collectively, these stages result in what Schumpeter calls the “creative destruction” of the old technological paradigm. In the “installation period” leading up to the crash, the new technology disrupts and permeates friendly markets. The “deployment period” following the crash sees the dissemination of the technology into hold-out markets, rejuvenating legacy infrastructure in these industries. The standard cycle takes 50–60 years. There have been five major technological revolutions in the last 250 years: the first Industrial Revolution; the Age of Steam and Railways, the second Industrial Revolution, the automobile era, and now the Information era.

We often use Perez’s model as one guide for understanding what’s going on in the macro-economy, and what possible technological breakthroughs are on the horizon. Perez’s framework suggests that we are now in the latter half of the fifth technological revolution. The IT wave arguably began when ARPANET adopted TCP/IP in 1982, as the spine of the Information Technology revolution is the Internet. The eruption of the Internet in the 1980s phased into the dot-com bubble of the 1990s, which burst catastrophically at the dawn of the new millennium. Internet mania is an excellent example of a true bubble. Technology stocks soared 300% from 1997 to 2000, and accounted for 35% of total public investment at the peak. P/E ratios were at astronomical levels, and paper fortunes were rapidly being made. But many stocks had zero profits and valuations were disconnected from discounted future cash flows. The crash was the turning point for the IT revolution.

If the crash of 2000 represented the turning point, then 2016 is the Golden Age of the information technology wave. Each wave lasts for around 50–60 years, and we are now in the middle of the deployment period. In the deployment period, the current technological paradigm will fully commercialize. Technology producers will control an increasingly large share of resources as they work to transform old business infrastructures and improve the lives of consumers. We are transitioning from the speculative, “casino economy” of the 1990s to a period where financial capital reconnects with builders and doers — those who scale functional platforms to create real value in an economy. As we move into the deployment phase of this IT wave, angel investing will become less profitable than growth-stage investing, as the real opportunity for capturing value creation will occur as young but growing enterprise companies expand to their full potential. Venture capital will continue to consolidate into those few larger firms poised to aggressively scale their novel, industry-winning data and workflow platforms.

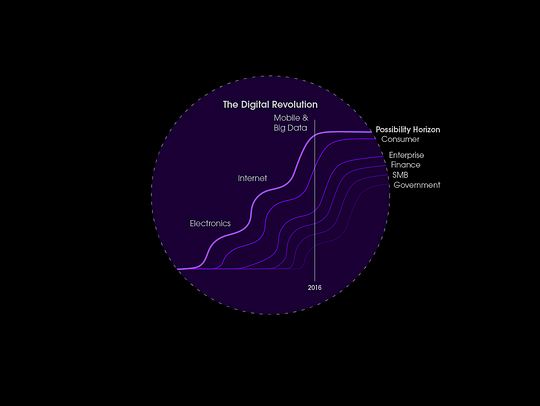

The unique thing about the current technological revolution is that a series of new innovations have “lifted” or “bumped” the possibility curve upwards and exaggerated the shape of the normal technology wave. If the Internet were a standard technology curve, then a post-2000 world would see the deployment of similar kinds of companies that existed pre-2000, perhaps with small iterations. But something different has happened. In the last 16 years, there have been several other inventions that have compounded the growth of the Internet era and pushed the bounds of what is possible. The invention and commercialization of the smartphone is one such example. In 2000, before the iPhone came to market, there were only 50 million people on the web. Today, there are 3 billion people online, with the majority of traffic driven by mobile.

Perhaps most importantly, the technology underlying the IT paradigm continues to rapidly increase in capacity. Since the dot-com crash of the early 2000s, the continual miniaturization of transistors and the compounding exponential growth of computational power has progressed so far that it has massively distorted the shape of the curve. Companies can now host their data on cloud providers such as Amazon on Microsoft, where they can spin up or down their storage as necessary. Paired with the commoditization of big data analytics frameworks such as Hadoop, this shift has opened the door for organizations to process and analyze hundreds of millions of data points in seconds. Companies can now solve complex, non-linear problems in ways that were not possible with the software built at the beginning of the IT wave in the 1970s and ’80s. The consequence of this extension of the installation period of the IT Revolution is what we have elsewhere been calling the “Smart Enterprise” wave.

Borrowing Perez’s terminology, each of these minor technological developments generates a kind of miniature installation period and market craze of its own. Successive inventions are creating new applications for the Internet as new devices and software connect to the cloud. In the present Golden Age, installation and deployment dynamics operate in tandem. Collectively, this process is fueling new opportunities to capitalize on the IT wave. Some of our partners and friends disagree with us on the question of whether new paradigm shifts will take place in the next decade. For instance, futurist Ray Kurzweil suggests that the rate of innovation is itself accelerating, and that new paradigms will occur at ever closer intervals in the future. Our view, however, is that the Smart Enterprise paradigm will remain the dominant one for the full generation predicted by Perez’s model, and that no upcoming paradigm (e.g. virtual reality, artificial intelligence) will be as transformative to the overall economy for quite some time. If our view is correct, then the best opportunities for putting capital to work will be at the growth stages of Smart Enterprise companies. That is not to say that there won’t be good opportunity for angels to capture in the Installation Phase of the next paradigm, or at the tail end of the Smart Enterprise wave. But the best opportunities will more and more skew towards Smart Enterprise companies with signs of early success and with 99% of the market left to capture. Consistent with this view, we are launching a co-invest fund to fuel companies poised to aggressively scale their platforms.

A technological revolution is like a rock thrown into a placid pond. It takes time for the ripples to reach the pond’s edge. As Perez notes, techno-economic paradigms “are highly uneven in coverage and timing, by sectors and by regions, in each country and across the world.” The Internet/big-data splash rippled through the consumer space in the 1990s and early 2000s, generating companies like Google, Facebook, and Amazon (the “Consumer Wave”), and creating enormous value. As depicted in the graphic below, it is now impacting a variety of formerly sequestered industries such as energy, finance, and government. These are trillion dollar industries with archaic information systems, employing human beings as middleware to perform routine data-processing and communication tasks. Perez explains that “institutional recomposition” occurs in the deployment period. Indeed, in our era, inefficient back-end infrastructure is being updated with state of the art information gathering, structuring, and analytics techniques– i.e. “Smart Enterprise” software.

The next generation of Smart Enterprise companies will create network effects by concentrating anonymized data from across the entire industry such that the more users there are, the better the industry data will become. Storage and cloud-computing will continue to become cheaper, more data will be created and processed, and progress in deep learning, neural nets, and AI will oust more and more human middleware. The Smart Enterprise wave will thus free up human minds for tackling questions which demand high levels of abstraction and creativity. Still, though, there will need to be a layer of human decision-making in core business processes for the foreseeable future.

In the excitement of Silicon Valley speculation, it’s important not to lose sight of the grander narrative of technological progress. The vast majority of the economy has yet to be transformed by the IT revolution — we are nowhere near the exhausted, fully-saturated markets of Perez’s “maturity” phase.Unlike the early consumer platforms, which have now attained behemoth status, the first flight of Smart Enterprise platforms have only touched a fraction of the major parts of the economy they are destined to impact. It is likely that Silicon Valley has already developed many if not the majority of the breakthroughs relevant to the current technological generation, and that Smart Enterprise companies are beginning to transition from adolescence to early adulthood. Over the coming decade, the most compelling opportunities will increasingly be these scaling-phase platform ventures, which will raise large amounts of capital and grow at high rates for years longer than most expect — generating exceptional financial returns. While the current zero interest-rate macroeconomic environment suggests that we may be in a macro-economic bubble, the technology sector is not a culprit. Perez’s model helps demonstrate that we are instead in the most productive period of the IT revolution, or in the words of the Bard, “afloat on the full sea of fortune.”

Joe Lonsdale

Partner, 8VC

Founder, Palantir and Addepar

Reid Spitz

Investor, 8VC

Clay Spence

Writer, 8VC