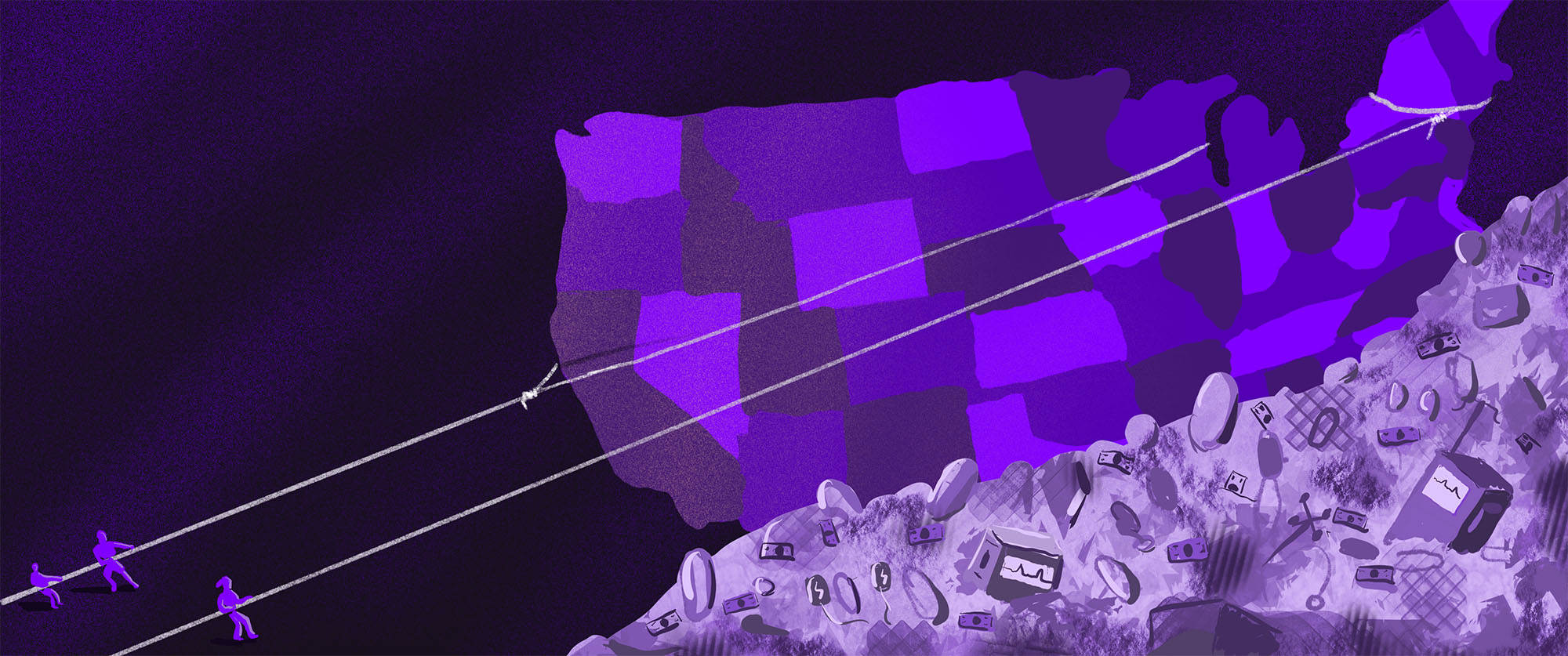

The American health care industry wastes $1T by some estimates,[1] and possibly as much as 30% of health care spending by others.[2] US health care expenditures are twice the OECD average — for instance, we spend twice what the UK does on health care (as a percentage of GDP) — and American health care costs are growing at 5% a year.[3][4]

Healthcare presents one of the greatest policy challenges for our country because profit incentives and care for the patient are often misaligned. It’s clear that the government is going to play some role in making sure the least well-off Americans have access to medicine, but we need healthcare policies that incentivize providers and payors to educate patients to make informed, data-driven choices. Only intelligent consumer choice will stimulate functioning, competitive markets in insurance, patient care, the pharmaceutical industry, and elsewhere. Today, pharmaceutical companies, health providers, electronic health record (EHR) systems, and other actors often have misaligned incentives and fail to enable more efficient solutions that do more for the patient per dollar — indeed, often the winners in these areas are those that unnecessarily charge more. Aligning incentives will spur top technology startups to develop innovative healthcare solutions, bring down costs, and deliver superior outcomes to American patients. Here are a few necessary reforms:

1) Medical Schools

Experts project a total physician shortfall of between 42,600 and 121,300 by 2030.[5][6]* We need more medical schools fast, but the Liaison Committee on Medical Education accreditation process takes 8 years on average and most states require new medical schools to obtain a “certificate of need” before beginning construction.[7] In addition, medical schools are required to sustain the high overhead of medical research rather than focusing exclusively on training doctors, and inflexible requirements prevent medical schools from experimenting with new curricula. Organic chemistry and other undergraduate prerequisites are completely irrelevant to becoming a good practicing doctor, and should be optional.[8]

High medical school costs force students to become high-earning specialists, e.g. plastic and orthopedic surgeons, when our country really needs more primary care physicians (PCPs). Primary care physicians, nurse practitioners, and physician’s assistants are far cheaper than specialists, but limited medical school and residency supply as well as occupational licensing concerns keep them out of the market. In addition, foreign doctors are almost always required to complete a full residency before being allowed to practice in the United States.[9] Given a current skills gap of 30,000 doctors, adding 30,000 new PCPs, nurse practitioners, or physicians assistants could save $2.3B, $5.1B, or $6B in salary costs alone relative to the current mix of specialists and primary care doctors.[10][11][12]

In addition, primary care doctors achieve better health outcomes for patients than specialists by engaging in long-term counselling, tracking, and preventive care.[13] Scholars estimate that replacing specialists with primary care physicians at a density of 1 per 10,000 population could save $931 per beneficiary a year.[14][15] Adding a supply of 30,000 primary care physicians would save our country about $150–200B a year.[16]

*If implemented correctly, data-driven telemedicine can ameliorate demand for physicians somewhat. Doctors should be able to digitally prescribe most drugs, and data from increasingly sophisticated wearables will enable physicians to swiftly and efficiently diagnose patients.

2) Reform PBMs

In 2017 the Centers for Medicare and Medicaid Services (CMS) spent $175B on prescription drugs alone, and there are curr\ently shortages of vital drugs across the country.[17][18] An oligopoly of Pharmacy Benefit Managers (PBMs) generates $200B a year in revenue by forcing drug manufacturers to pay rebates and other kickbacks in order for the PBM to place their drug on the “formulary”, or list of insurable drugs.[19][20] Securing a place on the formulary is a matter of life and death for manufacturers, and by one estimate the current value of rebates and other price concessions from manufacturers to PBMs increased from $59B in 2012 to $127B in 2016.[21]

After speaking extensively with politicians on both sides, we were thrilled to see the Senate recently outlaw PBM “gag-orders” on pharmacies by a 98–2 vote. We are encouraged to see that Alex Azar’s Department of Health and Human Services (HHS) is planning to subject PBM rebates to anti-kickback law, but we would go further and require full price transparency on PBM contracts in the style of Colorado HB 1260.[22] Although some rebate money flows to insurers, we estimate that reforming the space could save America on the order of $50B.

3) End of Life Palliative Care

Although discredited by hyperbolic language about “death panels”, counselling patients at end-of-life is both cost-effective and humane. 30% of Medicare expenditures are attributable to 5% of beneficiaries who die each year, and acute care in the final 30 days of life accounts for 78% of the costs incurred in the final year of life.[23] While acute-care for the dying should obviously be available to those who want it, our country must shift to a model of counselling and palliative care at the end of life.

Just having an end of life discussion with the cancer patient reduces medical costs by 35.7% on average, and given that there are roughly 600,000 cancer deaths in the United States a year, would have saved $687M a year for cancer patients in the last week of life alone! In addition accountable care organizations (ACOs) have saved $12,000 per patient during the final three months of life by implementing home-based palliative care. If extended to all cancer, end stage renal disease, and congestive heart failure patients this program could save the country $11.7B a year.[24]

We all agree that we must treat families of the dying with delicacy and compassion. But introducing a program by which families will share in Medicare/Medicaid savings from palliative care would help families and patients factor the overall social cost of end-of-life care into their decision calculus. We estimate that extending proven programs and testing different incentives structures could save our country $30–50B a year.

4) FDA Reform

Clinical trials are an arduous multi-year process and have become drastically more costly in the last 30 years.[25] Phase II and III efficacy trials cost roughly $400M per new drug, which severely limits the number of drugs that make it to the final stage of Food and Drug Administration (FDA) approval.[26] A “progressive approval” approach would allow drugs to be repurposed for other uses and possibly sold after passing Phase I safety trials, which establish that a drug has a favorable risk balance and qualifies as value-based care.[27]Drug companies could gradually establish efficacy by logging the effects the drug has on each person who opts to use it over the next several years.

The extreme costs of clinical trials and FDA approval not only stymie drug development and the application of treatments to new indications, they effectively privilege Big Pharma over other innovators, inhibiting innovation and medical progress. While ramping up the number of drugs approved may not save our healthcare system money on net, a framework which encourages innovation will positively impact millions of lives by improving quality of care.

5) Give Medicare Negotiating Power

To pass the Affordable Care Act (ACA), the Obama Administration made a critical concession: Medicare would not be able to negotiate the price of drugs by controlling which drugs make it onto Medicare’s formulary. As a consequence, our federal government is a “price taker” that must blindly accept whatever prices drug companies demand, and the American government winds up subsidizing drug development costs for the rest of the world. Drug prices at home are extremely high, representing 10% of total healthcare expenditures, and about $144B of federal healthcare spending.[28]

In many other developed countries, governments use their monopsony or near-monopsony buying power to force pharmaceutical companies to sell drugs at much cheaper rates. For instance, Canada spends 70% of what the US spends on brand name drugs, the UK 40% of what we spend, and Denmark only 35%.[29] If the US federal government used its considerably larger “countervailing power” to negotiate reduced drug prices — whether on a case by case basis or by pegging the value of a Quality Adjusted Life Year at a generous but fixed rate — savings could be in the range of $30–40B, possibly even as high as $90B a year.[30]

Pharmaceutical industry lobbyists (PhRMA) argue that high drug prices are necessary to stimulate R&D which generates many new life saving drugs every year. But in fact, median R&D spending on new cancer drugs — the most difficult to develop — is only around 40% of total revenue.[31][32] In addition, most R&D is funded by American universities, and manufacturers of silver-bullet specialty drugs could continue to charge high prices to a federal payor.[33] Giving government negotiating power isn’t a novel solution, but it’s one of the correct solutions to driving down drug costs for Americans.

6) Tort Law

The threat of malpractice lawsuits forces doctors to engage in costly defensive medicine. Although the current administration has made some progress on tort reform (making arbitration legal for federal contractors and nursing homes), Congress must insist on Texas-style reforms including capped punitive and noneconomic damages from healthcare providers, eliminating contingency fees for speculative tort lawyers, reinforced federal preemption doctrine for food and drug products, and more. [34][35][36] Unfortunately the trial lawyers lobby — one of the biggest political donors in the country — will fight reform at every step of the way.

Some studies estimate that reducing physician malpractice fears to “somewhat concerned” about malpractice would decrease costs by 14%, saving the country $100B a year. Others argue that medical liability reform could save our country up to $210B a year.[37] Congress must protect our doctors from being attacked by unscrupulous prosecutors in order to reduce the cost of healthcare for American citizens. We all agree that we must insist on protecting patients, but unchecked tort lawsuits just punish American patients and taxpayers with an unaffordable system.

7) Data Interoperability

The ACA’s “meaningful use” requirements did little to make healthcare data accessible. As of 2015, only 6% of health care providers could share patient data with other clinicians who use an EHR system different from their own. Although 21st Century Cures Act made “information blocking” illegal, big EHR vendors routinely prevent their competitors from importing patient data by disclosing health records in garbled, incoherent formats.[38][39] As a result, physicians are unable to make fully informed decisions about their patients.

Judy Faulkner, CEO of EPIC, famously condescended then Vice-President Biden, “Why do you want your medical records? They’re a thousand pages of which you understand 10.” The answer is that only real, semantic interoperability which makes health data available to third parties via and open application programming interface (API) will allow an innovation ecosystem of apps, medical devices, and novel insurance plans to flourish. Granular, transparent healthcare data will allow entrepreneurs — whether college students or IBM executives — to invent new solutions from the bottom up and swiftly incorporate best practices into their businesses. In addition, direct service-to-service comparisons will allow consumers to make informed decisions about how to stay healthy, stimulating market competition for their dollars.

We have been excited to see CMS’s Blue Button 2.0 API program formalize the Fast Healthcare Interoperability Resources (FHIR) standard for health records, which includes programmer resources, a complete API, and gives beneficiaries full control over their data — but EHR providers are refusing to use it.[41] While any EHR system should ensure compliance with the Health Insurance Portability and Accountability Act (HIPAA) by storing protected health information on secure servers, we need to make interoperability truly mandatory.

If patients could easily share their medical records with new providers and selectively reveal their data to health apps, fitness devices, diagnostic companies, insurers, and academic researchers, our entire healthcare industry would become hugely more affordable and effective. Reliable, real-time information about which treatments work, which failed, and what they cost will enable hospitals to identify and minimize cost centers as they strive to produce care more cheaply than federal benchmarks and share in the savings.

8) Financing Reform

Overtreatment and poor physician incentives may be the main driver of health care costs.[42] Most hospital networks are local monopolies with limited incentives to innovate or save money. Replacing this broken system with value-based care models will immediately save over $100B in total, and should grow steadily over time to $200–300B as doctors harness digital technology interventions and other new techniques to make care cheaper and more effective. We break down a few potential sources of savings below:

Bundled Payments

The Bundled Payment Care Initiative (“BPCI”) introduced in 2013 shows serious promise in making acute care clinical workflows more efficient, particularly in orthopedic care and oncology. Results continue to improve as providers adapt to the program.

After adopting a bundled payment model, the NYU Medical center reduced costs to Medicare by 10% and reduced patient stays by 25% for total hip arthroplasty procedures, and a private practice joint arthroplasty generated 20% savings for CMS per episode while decreasing readmissions.[43][44]The Congressional Budget Office estimates that a voluntary bundled payments system could save Medicare $6.6B a year.[45] If CMS makes bundled payments mandatory for both Medicare and Medicaid, achieves health record interoperability, and allows the ecosystem to iterate on data-driven incentives, we expect savings to surpass $100B.

Accountable Care Organizations

ACOs are widely seen as the Affordable Care Act’s main instrument to rein in health care spending, and ultimately we expect that bundled payments will be folded into a broader ACO model.[46][47] To date ACOs have generated modest savings on average, but some, such as the Memorial-Hermann ACO, have generated 11% savings for Medicare.[48][49] ACO contracts are more efficient if they involve two-sided risk (rewards for savings, penalties for overages), but studies have shown that even early versions of upside-risk only ACOs are associated with a 3% reduction in Medicare reimbursement.[50] In addition, Medicare ACOs have improved quality measures across the board, despite their elderly populations.[51]

Provider networks are still adjusting to the ACO model, and returns will increase in the future. Projecting savings at 5–10% and assuming that all Medicare beneficiaries are enrolled in ACO providers, ACOs would save Medicare $30–60B a year.[52] If extended to Medicare and Medicaid, full ACO enrollment could generate between $56–112B a year.[53]

Preventive Medicine

The ACA now mandates coverage for all evidence-based prevention in non-grandfathered plans, so preventative screening and vaccinations have increased since the advent of Obamacare.[54] However we need to drastically increase the scope of preventive medicine under the aegis of value-based care. Preventable chronic diseases are 7 of 10 top causes of death in the country, and account for 75% of health care costs.[55] Half of American adults have chronic disease, and surprisingly, chronic illness among those younger than 65 years accounts for 67% of total medical spending.[56] 70% of American adults are overweight, and 1 in 3 American kids and teens is overweight or obese.[57] Prevalence of obesity has tripled since 1971.[58]

Some of the most cost-effective, successful preventive health interventions include childhood immunization, youth and adult tobacco counselling, alcoholism interventions, aspirin use for people with heart disease, and screenings for common cancers, STDs, and chronic conditions like hypertension.[59] Evidence suggests that many other preventive health interventions are cost-neutral or increase long-term medical costs (because they extend lifespans). However critics often miss the fact that preventive health measures will extend the working careers of Americans, and pay for themselves in the long-run.

In kidney care, for example, the federal government subsidizes extremely costly dialysis treatments for end stage renal disease patients but has not crafted incentives to perform preventative treatments before a patient advances to this critical, debilitating condition. Rather than fill the coffers of the corrupt duopoly that runs the dialysis industry, we should give providers incentives to halt the progression of kidney disease in its tracks. As a country we spend $42B on hemodialysis. Just getting prevention right here could save our system north of $10B a year.

Conclusion

Fixing our sprawling, tangled healthcare system is one of our nation’s greatest policy challenges. In the coming years, America should move swiftly to embrace value-based care models which align market incentives to produce a wealth of patient data and an ecosystem of new information technologies geared at preventive treatment. At the same time, we must address specific areas where poor incentives have throttled the production and delivery of medical services. Replacing bureaucratic mandates with proven Western values of entrepreneurial innovation and educated individual decision-making will yield better patient experiences and results for Americans from every walk of life while saving our country $600-$900B annually — a transformative amount of money for the well-being of our nation.

This paper is a work in progress and we intend to publish new versions of our recommendations as we continue to talk to practitioners and refine our views on healthcare policy. This is the latest version of our views as of October 15, 2018. American healthcare is a complicated space, and we would appreciate any feedback or suggestions.

Joe Lonsdale

Partner, 8VC

8VC is a San Francisco based venture capital firm investing in industry-transforming companies. For more information, or to sign up for our newsletter visit www.8vc.com

Endnotes

[1] Sahni, Nikhil et al. “How the U.S. Can Reduce Waste in Health Care Spending by $1 Trillion.” Harvard Business Review, 2015.

[2] Blumenthal, David et al. “Health Care Spending — A Giant Slain or Sleeping?” New England Journal of Medicine, December 2013.

[3] Squires, David and Chloe Anderson. “U.S. Health Care from a Global Perspective.” The Commonwealth Fund, 2015.

[4]“Average Annual Percent Growth in Health Care Expenditures per Capita by State of Residence.” Kaiser Family Foundation, 2014.

[5] Moses et al, ibid.

[6] “The Complexities of Physician Supply and Demand: Projections from 2016 to 2030: 2018 Update.” Association of American Medical Colleges, HIS Markit Ltd. March 2018.

[7] Stark, Roger. “The Looming Doctor Shortage.” Washington Policy Center, November 2011.

[8] https://www.ncbi.nlm.nih.gov/pmc/articles/PMC3824759/

[9] https://www.statnews.com/2017/05/15/missouri-doctor-dearth/

[10] The average yearly salary of a doctor (given current percentages of specialists vs. PCPs) is $300k, see Kane, Leslie. “Medscape Physician Compensation Report 2018.” April 11, 2018.

[11] The average yearly cost of a Nurse Practitioners and Physicians Assistants is about $100,000 a year. See https://nurse.org/articles/nurse-practitioner-ranks-2nd-US-2017/ and https://money.usnews.com/careers/best-jobs/physician-assistant/salary

[12] Physicians Assistants can handle 86% of the diagnoses seen in outpatient primary care settings. See Eibner et al. “Controlling Health Care Spending in Massachusetts: An Analysis of Options.” Rand, 2009.

[13] Starfield et al. “The Effects of Specialist Supply on Population’s’ Health.” Health Affairs, 2005.

[14] American College of Physicians. “How is a Shortage of Primary Care Physicians Affecting the Quality and Cost of Medical Care?” 2008.

[15] Adjusted for inflation. See: Baicker, Katherine and Amitabh Chandra. “Medicare Spending, The Physician Workforce, And Beneficiaries’ Quality of Care.” Health Affairs, 2004.

[16] Our current physician skills gap is currently around 30,000 doctors, see: “The Complexities of Physician Supply and Demand.” Since the current physician workforce composition is 2/3rds specialists and 1/3rd PCPs, a base case for solving the skills gap would be to create 20,000 more specialists and 10,000 more PCPs. Replacing 20,000 specialists with PCPs would generate savings of $931 * 20,000 doctors * 10,000 beneficiaries per doctor, or $186B a year.

[17] https://www.kff.org/infographic/10-essential-facts-about-medicare-and-prescription-drug-spending/

[18] “Urgent Call to Action!” Physicians Against Drug Shortages,

[19] Neeraj Sood, Dana Goldman & Karen Van Nuys, Follow the Money to Understand How Drug Profits Flow, STAT (Dec. 15, 2017)

[20] “Amber Rainey, Christina Kollmeyer, and Lisa Vogel v. Mylan Specialty L.P.” United States District Court, Western District of Washington at Seattle. 2018.

[21] Fein, Adam. “New Data Show the Gross-to-Net Rebate Bubble Growing Even Bigger.” Drug Channels, June 14, 2017.

[22] https://www.reuters.com/article/us-usa-healthcare-kickbacks/trump-administration-proposes-altering-rule-on-drug-rebates-idUSKBN1K92ON

[23] Zhang et al. “Health Care Costs in the Last Week of Life.” Arch Intern Med, 2009.

[24] 600,000 cancer mortalities + 287,000 congestive heart failure mortalities + 89,000 ESRD mortalities yields 976,000 mortalities a year that could be addressed with palliative care. For ACO savings, see: Lustbader et al. “The Impact of a Home-Based Palliative Care Program in an Accountable Care Organization.” Journal of Palliative Medicine, 2017.

[25] Berndt, Ernst and Iain Cockburn. “Price Indexes for Clinical Trial Research: A Feasibility Study.” 2014.

[26] Adjusted for inflation. See: DiMasi et al. “Innovation in the Pharmaceutical Industry: New Estimates of R&D Costs.” Journal of Health Economics, 2016.

[27] Caplan, Arnold and Michael West. “Progressive Approval: A Proposal for a New Regulatory Pathway for Regenerative Medicine.” Stem Cells Translational Medicine, 2014.

[28] https://www.kff.org/infographic/10-essential-facts-about-medicare-and-prescription-drug-spending/

[29] Woo, Nicole and Dean Baker. “State Savings with an Efficient Medicare Prescription Drug Benefit.” CEPR, March 2013.

[30] The USFG spends $144B on prescription drugs a year.

[31] https://www.washingtonpost.com/news/wonk/wp/2015/02/11/big-pharmaceutical-companies-are-spending-far-more-on-marketing-than-research/?utm_term=.828fb80bac8a

[32] Prasad, Vinay and Sham Mailankody. “Research and Development Spending to Bring a Single Cancer Drug to Market and Revenues After Approval.” JAMA, 2017.

[33] Kirkwood, John. “Buyer Power and Healthcare Prices.” Washington Law Review, 2015.

[34] Carter, Terry. “Tort Reform Texas Style.” ABA Journal, 2006.

[35] https://www.law360.com/articles/906301/trump-kills-government-contractor-blacklisting-rule

[36] http://thehill.com/policy/finance/358297-trump-repeals-consumer-bureau-arbitration-rule-joined-by-heads-of-banking

[37] 2016 data from CMS indicates that America spent $665B on physicians; 665*.14 = $93B, and it’s certainly higher today. Reschovsky and Cynthia B. Saointz-Martinez. “Malpractice Claim Fears and the Costs of Treating Medicare Patients: A New Approach to Estimating the Costs of Defensive Medicine.” Health Services Research, 2018.

[38] Reisman, Miriam. “EHRs: The Challenge of Making Electronic Data Usable and Interoperable.” Pharmacy and Therapeutics, 2017.

[39] Adler-Milstein, Julia and Eric Pfiefer. “Information Blocking: Is it Occurring and What Policy Strategies Can Address It?” The Milbank Quarterly, 2017.

[40] Feldman et al. “The State of Data in Healthcare: Path Towards Standardization.” Manuscript, 2018.

[41]https://en.wikipedia.org/wiki/Fast_Healthcare_Interoperability_Resources

[42] Gawande, Atul. “The Cost Conundrum.” The New Yorker, 2009.

[43] Iorio et al. “Early Results of Medicare’s Bundled Payment Initiative for a 90-day Total Joint Arthroplasty Episode of Care.” The Journal of Arthroplasty, 2016.

[44] Preston et al. “Bundled Payments for Care Improvement in the Private Sector: A Win for Everyone.” The Journal of Arthroplasty, March 2018.

[45] http://www.cbo.gov/sites/default/files/cbofiles/attachments/44761-Wharton.pdf

[46] Barnes, Andrew et al. “Accountable Care Organizations in the USA: Types, Developments and Challenges.” Health Policy, 2014.

[47] Colla, ibid.

[48] Colla, Carrie and Elliott Fisher. “Moving Forward with Accountable Care Organizations: Some Answers, More Questions.” JAMA Internal Medicine, April 2017.

[49] Kim et al. “A Direct Experience in New Accountable Care Organization: Results, Challenges, and the Role of the Neurosurgeon.” N13% of health care expenditures eurosurgery, April 2017.

[50] McWilliams, J. Michael. “Changes in Medicare Shared Savings Program Savings from 2013 to 2014.” JAMA, October 25, 2016.

[51] Bleser et al. “ACO Quality Over Time.” The American Journal of Accountable Care, March 2018.

[52] Total Medicare expenditures in 2017 were $702; excluding part D prescription drug payments yields $602B. See: Cubanski, Juliette and Tricia Neuman. “The Facts on Medicare Spending and Financing.” KFF, Jun 22, 2018.

[53] Non-drug Medicaid spending in 2017 was around $520B. See: “Rudowitz, Robin and Allison Valentine. “Medicaid Enrollment and Spending Growth: FY 2017 & 2018.” KFF, Oct 19, 2017.

[54] Maciosek et al. “Updated Priorities Among Effective Clinical Preventive Services.” Annals of Family Medicine, 2017.

[55] Chatterjee et al. “Checkup Time: Chronic Disease and Wellness in America.” Milken Institute, 2014.

[56] Moses et al., ibid.

[57] https://www.cdc.gov/nchs/fastats/obesity-overweight.htm

[58]http://www.heart.org/HEARTORG/HealthyLiving/HealthyKids/ChildhoodObesity/Overweight-in-Children_UCM_304054_Article.jsp#.W5s5i-hKibg

[59] Maciosek, ibid.